It is interesting to see a set of data from the German E-cigarette Trade Association today because this set of data indicates a “change” in the German e-cigarette market.

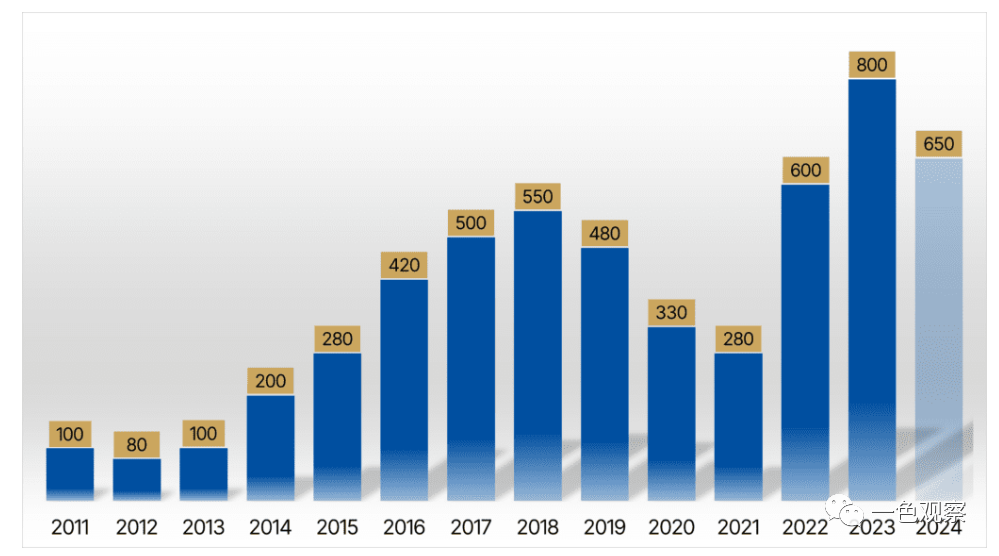

According to the latest data reported by the German Electronic Cigarette Trade Association (VdeH), Germany’s e-cigarette oil has been reduced by half, and the number of e-cigarette retail stores has dropped to about 1,000, a decrease of basically 30%. The core reason for this is the market shift brought about by Germany’s high e-liquid taxes and market competition.

(Deutsche Daten)

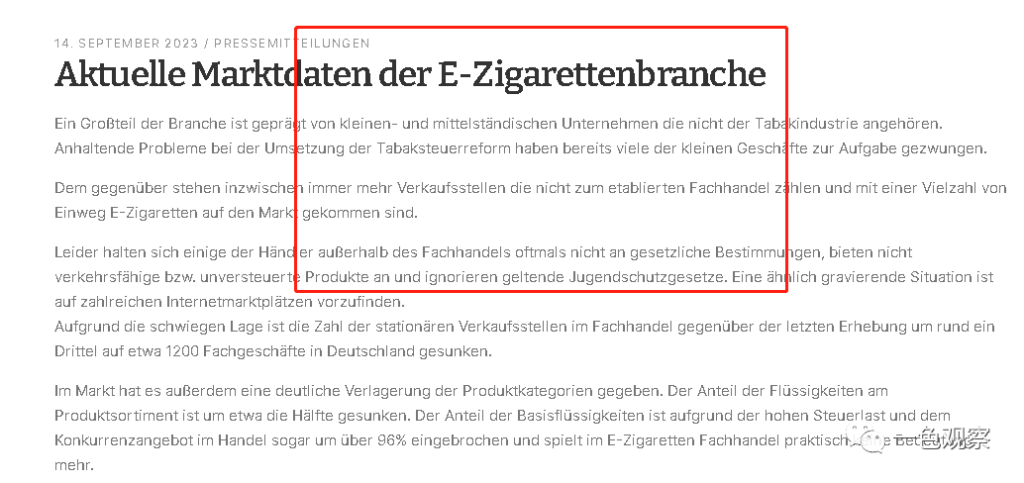

Damit einher geht ein Rückgang der Zahl der E-Zigaretten-Shops. Der Bundesverband E-Zigaretten-Handel wies darauf hin, dass die Zahl der physischen Verkaufsstellen im deutschen E-Zigaretten-Fachhandel um rund ein Drittel auf rund 1.200 gesunken sei. Die Analyse wies auch darauf hin, dass der größte Teil des Marktes in der deutschen E-Zigaretten-Industrie von kleinen und mittleren E-Zigaretten-Unternehmen dominiert wird, die keine Tabakunternehmen sind. Allerdings führten anhaltende Probleme bei der Umsetzung der Reform der Tabaksteuer dazu, dass viele kleine Geschäfte schließen mussten. Außerdem wurde darauf hingewiesen, dass in Deutschland immer mehr Verkaufsstellen des nichtprofessionellen Einzelhandels in den Markt strömen, um Einweg-E-Zigaretten zu verkaufen.

Reloadable products will replace disposables!

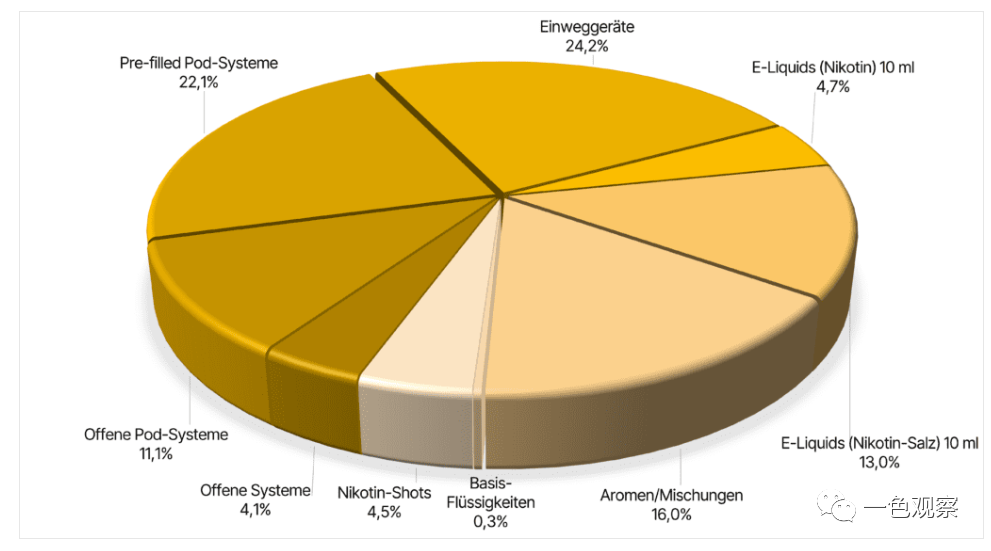

According to data from the German Electronic Cigarette Trade Association (VdeH), the current proportion of disposable devices in the German market is only 24.2%, a decrease of 30%; while PODs with prefilled systems account for 22.1%, which is basically the new high level of reloading.

Open POD equipment accounted for 11.1%.

(Latest equipment distribution in Germany)

More rechargeable cartridges are favored by the market because they are equally convenient and practical to use and have no environmental issues.

Will the e-liquid product system change?

According to data from the German Electronic Cigarette Trade Association (VdeH), the product categories in the German e-cigarette market have undergone a significant shift, with the proportion of e-liquid products in the product series falling by about half.

Due to high taxes and market competition, the proportion of basic liquid products has even dropped by more than 96%, and is almost no longer important in professional e-cigarette retail.

However, there is growth in the bottled oil market, with 10ML bottles accounting for 13%.

The current compliance procedures in the German e-cigarette market are relatively cumbersome and require more time. That is to say, the packaging and compliance information of German e-cigarette products require strict supervision, which requires brand manufacturers to invest more costs in this area. In addition, if a product carries a “warning label” in other countries, it cannot be sold directly in Germany and needs to be reprocessed to comply with German regulatory requirements.

Since Germany imposed taxes on e-liquids, many smaller dealers have ceased operations within three months. In addition, some brands also face certain restrictions and increased costs.

It can be said that before 2021, disposable products had almost no market in Germany, but they will make a large sales contribution in 2021-2022. Now at the end of 2023, the market may also be changing. It now appears that prefilled closed pod systems are taking an increasing share of the German market. These are simple rechargeable devices that only require the replacement of the liquid cartridge. In the medium term, these devices will largely replace single-use devices.

It is also noted that the upcoming restrictions on flavoring products are significantly slowing down the further development of the market. It expects the market to continue growing in 2023, but will flatline in 2024. Because the tobacco industry began selling its own disposable e-cigarettes for the first time in 2023, their sales contributed to the overall sales growth. But this positive trend will not continue in this form.

(Germany Future Market)

Perhaps, many companies will start to bet on the future of Germany and even Europe, which has a market of more than 3 million e-cigarette users.