Navigating the Evolving Landscape of E-Cigarette Taxation in the United States

As the e-cigarette industry in the United States evolves, regulatory and tax policies are subject to change. States may adjust existing tax rates, introduce new tax policies, or modify restrictions on the sale and use of e-cigarettes. These changes are often aimed at controlling youth access to e-cigarettes or increasing tax revenue to support public projects.

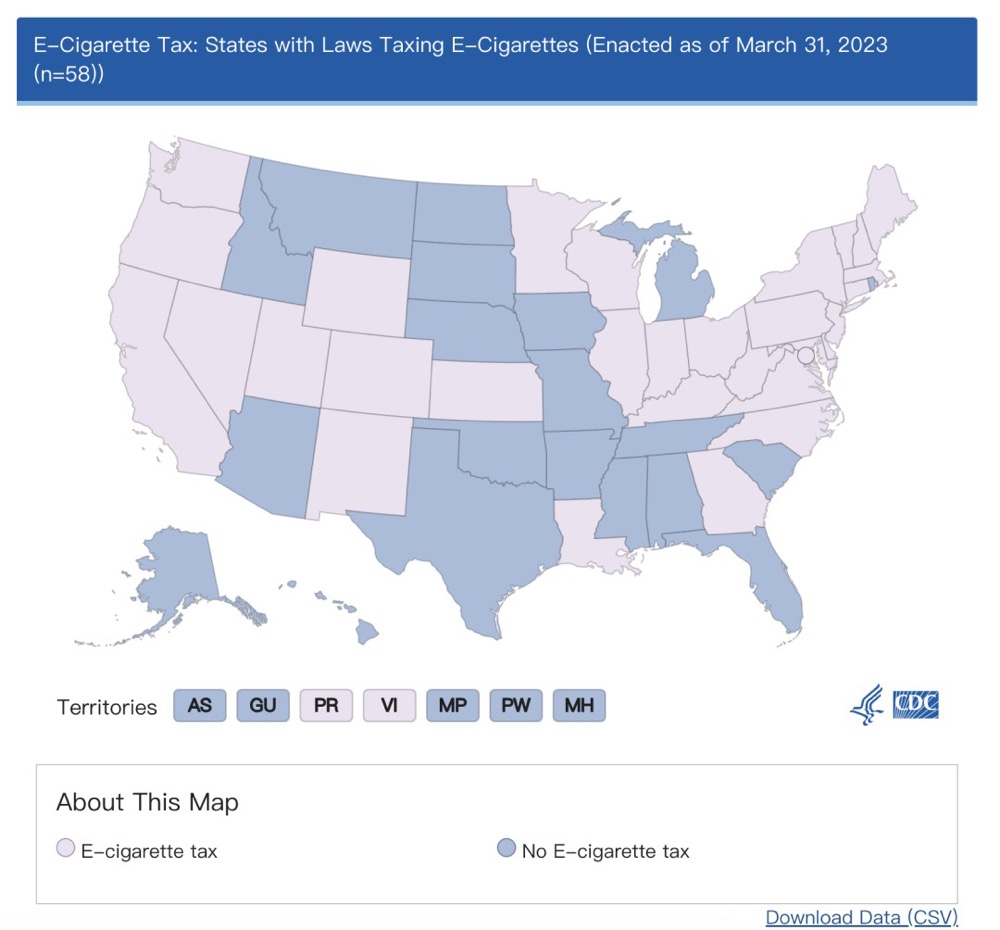

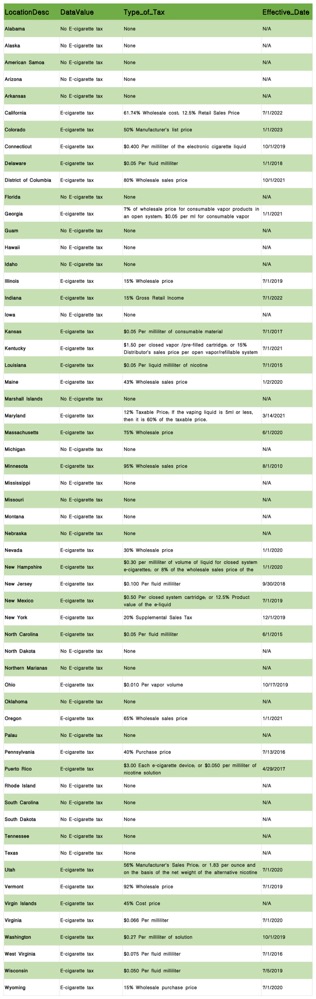

In this detailed analysis, we will explore the current state of e-cigarette taxation in the U.S., the potential changes on the horizon, and strategies e-cigarette businesses can adopt to navigate this shifting landscape. The data for this comprehensive overview is sourced from the Centers for Disease Control and Prevention (CDC) as of 2024.

Understanding E-Cigarette Taxation in the U.S.

E-cigarette taxation in the U.S. varies by state, with some imposing specific taxes on e-cigarettes and others incorporating them into broader tobacco product taxation. The tax rates and structures can differ significantly, influencing market dynamics in each state.

State-by-State Variations:

- Tax Rates: Some states have a percentage-based tax, while others have a fixed amount per unit or milliliter of e-liquid.

- Tax Structures: Tax structures range from wholesale taxes to retail taxes, and some states may even have a combination of both.

Anticipated Changes and Trends in E-Cigarette Taxation

With time, states may revise their e-cigarette tax policies to address public health concerns or fiscal needs.

Potential Policy Shifts:

- Increased Tax Rates: States might increase tax rates to discourage e-cigarette usage, particularly among the youth.

- Broadening Tax Bases: Expansion of the tax base to include more e-cigarette products and accessories.

- Public Health Initiatives: Some states may allocate a portion of e-cigarette tax revenue to fund public health campaigns and smoking cessation programs.

Strategies for E-Cigarette Businesses in Response to Tax Changes

To stay ahead of potential legislative changes, e-cigarette companies can adopt the following strategies:

Monitor Legislative Changes:

- Stay Informed: Keep abreast of regulatory and tax policy changes in each state. Establish a dedicated team or seek legal advice for timely updates and adaptation to new policies.

Diversify Product Lines:

- Compliance with State Regulations: Develop products that comply with various state regulations, and offer a diverse range of flavors and nicotine strengths to meet market demands.

Social Responsibility and Compliance:

- Public Health Initiatives: Actively participate in public health campaigns and ensure products meet safety and health standards. Collaborate with regulatory bodies to ensure compliance.

Market Adjustments and Positioning:

- Adapt to Market Needs: Flexibly adjust market positioning and marketing strategies based on state tax policies and market demands. Develop tailored sales strategies for different regions.

Policy Advocacy:

- Industry Representation: Actively engage in industry associations or interest groups to advocate for fair and reasonable regulations and tax policies.

Conclusion: Preparing for the Future

Understanding the nuances of e-cigarette taxation in each state and being ready to adjust strategies accordingly is crucial for industry players. Businesses need to continuously adapt to the changing regulatory environment and maintain keen market insights to ensure sustainable growth and compliant operations.

As we look ahead to 2024 and beyond, staying informed about the state of e-cigarette taxation in the U.S. will be vital for making informed decisions and navigating the future of the American market. For the latest updates and comprehensive data on U.S. e-cigarette taxation, visit The Insider’s Views.