However, Ireland will start in 2025, so there is still at least one year to buffer from now. Ireland is also the most violent country at one time.

It seems that the European system of taxing vaping may become a trend. The root cause of this may be a one-off, because one sentence in particular said, “The use of electronic atomization by young people has exploded, and the emergence of one-times has further promoted this trend. We can no longer delay the imposition of this Taxes.”

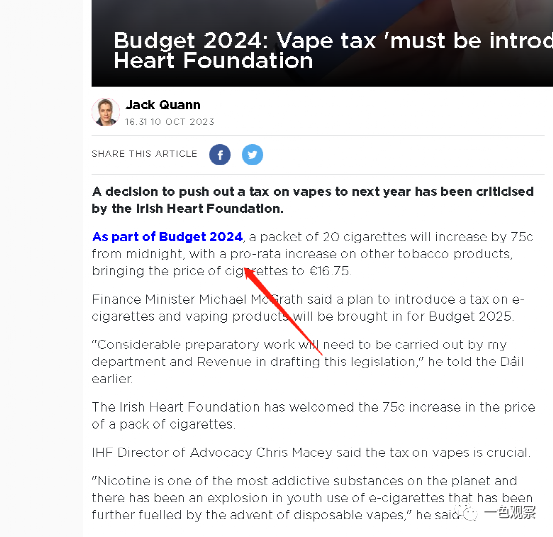

According to reports from Overseas Buzz, in Ireland’s 2024 budget, vaping will be taxed from 2025. Irish Finance Minister Michael McGrath confirmed the news. At the same time, Ireland will also increase the price of cigarettes, which will stimulate consumers to switch to e-cigarettes. At the same time, Ireland proposes to increase the tax on e-cigarette oil by 10 cents per milliliter. This means that the price of disposable e-cigarettes will usually increase by 25%, or 2 euros per tube.

(Ireland has also started collecting taxes)

McGrath said at the conference that the total budget in 2024 will reach 14 billion euros. The budget increases cigarette tax by 75 cents, raising the price of the most popular cigarette pack to 16.75 euros. Other tobacco products will also rise proportionally. This is the eighth consecutive year that cigarette taxes have been increased, but this increase is the largest in that period. The cigarette tax has been increased by 50 euro cents per pack of 20 cigarettes for the past seven years. Ireland (IHF) hopes to raise the price of a pack of cigarettes to €20 by 2025 to combat the growing number of young people smoking.

In terms of e-cigarettes, Ireland’s 2025 budget will charge domestic taxes on e-cigarette products, and use this tax to prevent young people from using e-cigarettes. Meanwhile, McGrath told the House of Representatives at the time of the budget announcement that “a significant amount of preparatory work was required by my department and the tax department in drafting this legislation”. It also said, “The current legislation banning the sale of vaping to teenagers under 18 years of age has been delayed for many years and we still don’t know when it will be implemented. The collection of vaping taxes should not be subject to unnecessary delays. And more than half of the EU Member states have already imposed additional taxes on vaping to protect children’s health.”

But it won’t unduly penalize people who use vaping as a method to quit smoking.

At present, a disposable payment in Ireland is nearly 8 euros. For young people, the cost of vaping is almost half that of smoking.

From this point of view, a pack of cigarettes in Ireland costs 16 euros, and a disposable price is only 8 euros. There is a huge price difference.

Ireland, with a population of more than 5 million, is a Western European country, bordering Northern Ireland in the northeast. It is basically a neighbor of the United Kingdom. What is concerning is that this is a highly developed capitalist country with an average salary of up to 60,000 euros per year, which is much higher than the EU level. It has excellent benefits and a vast vaping consumer market. This country also has a strong drinking culture, loving beer and whiskey, music and dancing, which are typical of the e-cigarette consumption scene.

Disposables are currently super popular in Ireland. According to data, 1.3 million disposables are discarded every week. This country recognizes vaping very much, and 1 in 10 people is a user. In particular, a quarter of Irish people aged 25 to 34 have tried vaping.

But currently 70% of people in this country are opposed to disposable products. It is expected that the e-atomizer category will also change in the future, and there is also discussion about banning disposable products, including restrictions on flavors. There is even a resolution in the European Union that could ban disposables by 2027.

Now it seems that Ireland is also strengthening the taxation of e-cigarettes and increasing the disposable price through tax rates, but they also mentioned that they do not want to crack down on the services of e-cigarette substitutes. It is also expected that the European market will develop more steadily in the future, which will also put forward higher requirements for the development of electronic atomization.

It is urgent to accelerate the development of the European market and cooperate in the development of the European electronic atomization market. We are currently promoting channel development in the UK, Spain, Russia, and Indonesia; the Middle East and Poland are already in progress!