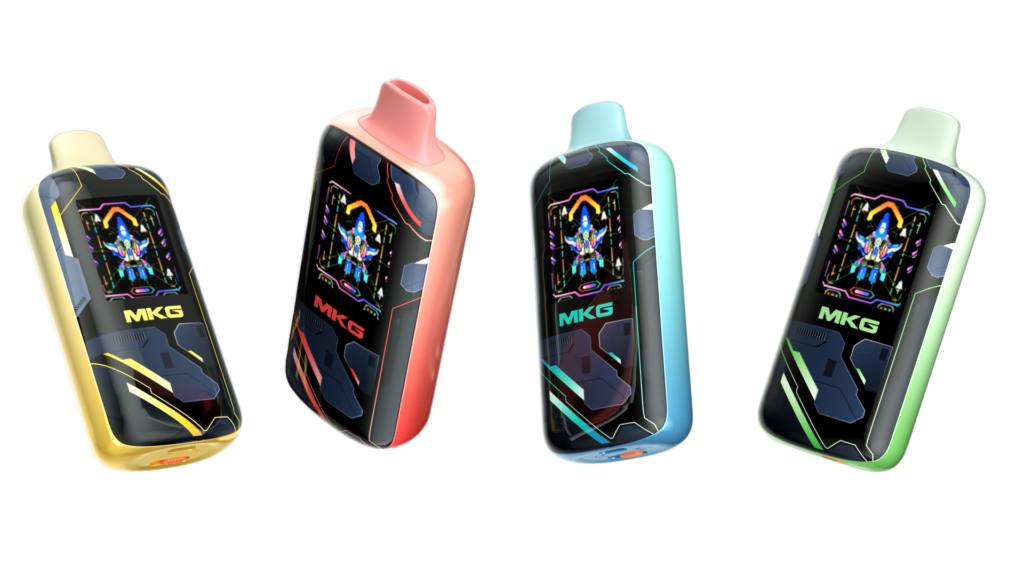

Digital Display

MKG VAPE TRENDS

Is the e-cigarette market in the Middle East easy to do?

Some people say that e-cigarettes in the Middle East are more like “nightclubs”. Although it has been said, there is some truth. Recently, the Middle East has become the focus of international attention. The football “World Cup” that will open on November 21, 2022 (early morning Beijing time) will be held in the famous “Qatar” in the Middle East. The favorite to win the championship became a topic for a while, the Brazilian team? French team? Argentina? England?

In fact, the Middle East has not only had a booming economy in the past few years, but also new types of e-cigarettes have attracted much attention. On the Qatar Peninsula on the southwest coast of the Persian Gulf, the coastline reaches 563 kilometers on a land of 11,000 square kilometers, and the scenery is simply infinite. However, Qatar currently bans e-cigarettes (it also stipulates that smoking e-cigarettes in the 2022 World Cup in Qatar will face a fine or 3 months in prison, which means that e-cigarettes cannot be brought to the World Cup), but compared to Qatar’s ban on e-cigarettes, Most wealthy countries in the Middle East are very open to e-cigarettes. Qatar is an Arab country in western Asia, bordering the United Arab Emirates and Saudi Arabia, the hottest e-cigarettes in the Middle East.

A few thoughts on the Middle East market.

1. Investment boom.

In the past two years, many factories have been built in Southeast Asia, but few factories have been built in the Middle East. For example, a Shenzhen electronic cigarette company in China spent more than 400 million yuan to build a factory in Southeast Asia and Indonesia this year. For example, in November, the Indonesian Tobacco Company also invested US$166.1 million to build an IQOS factory for Philip Morris International…

In fact, e-cigarettes in the Middle East started with the release of e-cigarettes in the United Arab Emirates in 2019. Its investment boom is not necessarily to build factories in the Middle East, but more to increase the supply of e-cigarettes in the Middle East. Another perspective shows that the support of Chinese e-cigarette factories is very much needed.

In the early years, in Southeast Asian countries and the Middle East, most countries tended to adopt e-cigarette bans, that is, directly prohibit the import and sale of e-cigarettes, and curb the sale of e-cigarettes from the source.

But now, the Middle East and Southeast Asia are gradually releasing the trend of e-cigarettes. Countries like the United Arab Emirates in the Middle East, Egypt in North Africa, and Arabia are all open to e-cigarettes.

A large amount of demand is the observability of the market. The Middle East spans about 23 countries and regions, covers an area of more than 15 million square kilometers, and has a population of 490 million. The size of this land seems to be larger than China’s 9.6 million square kilometers, and the population is larger than that of the United States.

2.Export foreign trade “hot”

The continuous acceleration of the growth of e-cigarette foreign trade has prompted most domestic manufacturers to pay attention to overseas markets.

For example, a set of data shows that the total export value of my country’s e-cigarette industry last year was 21.394 billion US dollars, and from January to April 2022 this year, my country’s total e-cigarette exports reached 6.168 billion US dollars, and it took 4 months to complete more than 30 billion yuan. Exports, the growth rate is still fierce. The 2022 E-cigarette Industry Export Blue Book report shows that the overseas e-cigarette market is expected to maintain a growth rate of 35% in 2022.

Like the brand MKG, it already has a layout in Saudi Arabia, the United Arab Emirates, and Kuwait in the Middle East. This year, it also held e-cigarette training in Saudi Arabia.

Many domestic manufacturers have also contracted a large number of ODM and OEM business of various types of electronic cigarette products in the Middle East, including smart electronic cigarettes, bomb-changing electronic cigarettes, disposable small cigarettes, and large cigarettes. Mainly exported to the Middle East, Russia and North Africa and other regions.

Customs-related export data show that the growth rate of e-cigarettes exported to the UAE is extremely fast, close to a multiple increase. In particular, the data of e-cigarettes exported to the United Arab Emirates is even nearly twice that of Bahrain.

3. The exhibition is “hot”.

This year, an important e-cigarette conference was held in the Middle East. At that time, the 2022 World Electronic Cigarette Exhibition was held for the first time in Dubai, UAE. Thousands of international merchants displayed electronic cigarette products, manufacturing parts, e-liquid, testing technology and other related products at the exhibition. Surprisingly, local businesses are pushing for a market scheme like the UK’s ‘regulation as a consumer product and drug’, where e-cigarettes are medical products and doctors can recommend them to heavy smokers. It can be seen that e-cigarettes are gaining awareness in the Middle East as a substitute for tobacco.

In June of this year, domestic companies such as MKG, Grapefruit, Magic Flute, Smol, etc., all attended the Dubai Electronic Cigarette Exhibition in the Middle East, UAE, and there were more than 200 brands and manufacturers.

4. The policy is still relatively “loose”

New tobacco policies in the Middle East are mostly formulated with reference to the EU. Several Middle Eastern countries that lifted the ban on new-type tobacco refer to the EU TPD, which is more friendly to e-cigarettes, and North Africa, which borders the Middle East, is also gradually liberalizing its policies.

It can be said that there are relatively few strict regulations on e-cigarettes in Middle Eastern countries. However, there are still some detailed requirements. For example, Kuwait has requirements for packaging, and e-liquid and machines need to be packaged separately.

At present, more than 20 countries in the Middle East, the United Arab Emirates, Kuwait, Saudi Arabia, Jordan, Egypt, and Bahrain are legally sold, while Lebanon, Oman, and Qatar e-cigarettes and related products are banned. Among them, the growth rate of the e-cigarette market in the United Arab Emirates is the fastest. According to Tim Philips, general manager of Ecig Intelligence, the sales of the top 10 stores in the UAE are generally increasing this year, and the growth rate of the UAE market is much faster than that of its neighboring countries.

The liberalization of the six countries in the Middle East is a big boost to e-cigarettes, not to mention the huge base of traditional smokers in the Middle East, the local shisha culture, and the spending power of Middle Eastern people. This is the “opportunity” for the emergence of new tobacco.

For example, Egypt also started to release e-cigarettes in October last year. It abolished the ban on the sale, import and marketing of e-cigarettes since 2015, which can be seen as “friendly”. The original intention was to eliminate “illegal trade”.

5. “Disposable” opportunities.

In the Middle East this year, there are many opportunities for disposable e-cigarettes to appear. Most new products point to one-offs.

Different countries and regions have different living cultures and consumption habits, and they are also very particular about the sweetness and taste of products, as well as the functions and design strength of electronic cigarettes.

The Disposable explosive growth in the world is rooted in convenience, price, taste, and capacity.

The Disposable favor is also based on the endorsement of new tobacco harm reduction and relative safety, which promotes market penetration.

Some of the problems that e-cigarettes in the Middle East may face this year.

1. Changing tastes and complex regulatory situation.

In fact, the world is currently not very friendly to flavored e-cigarettes. However, the Middle East remains open for now. But it can also be seen that from taste to taste limit, the regulatory situation is complicated, and a wave of opportunities should be seized as soon as possible. The data also shows that 90% of the UAE in the Middle East are mainly flavored e-cigarettes. Only 14% are tobacco-flavored e-cigarettes, which is almost the same as in China. Statistics show that 76% of e-cigarette products sold in the UAE are not tobacco-flavored, with buyers opting for sweeter varieties. The most popular choice was fruit flavors, which accounted for 39% of sales, with the rest of the market comprised of cool mint flavors at 21%, tobacco flavors at 14%, dessert flavors at 12%, sweet candy at 7% and beverage flavors at 6%. composition.

It can only be said that the future of e-cigarette overseas markets will depend on “policy evolution”.

2. “Standardization” process.

In order to prevent the influence of e-cigarettes on young people, e-cigarette regulations are also being promoted in the Middle East.

Including age restrictions, place restrictions, nicotine content restrictions, taste restrictions, etc. As stipulated by the United Arab Emirates, “the nicotine content in e-liquid shall not exceed 20 mg/ml”. Product launch requires ECAS RoHS certification.

3. “Taxation” issue.

Whether it is tariffs or its own e-cigarette consumption tax, it is actually perfected in the Middle East. May increase. For example, the UAE stipulates that any e-cigarette device, whether it contains nicotine or tobacco, including liquids used in e-cigarette devices will be taxed 100%.

4. “Logistics” filing type.

At present, electronic cigarettes are sensitive goods in international express delivery, and the logistics link cannot be ignored. In china there are a series of control regulations on the transportation of e-cigarettes. According to the “E-cigarette Logistics Management Rules”, the export of e-cigarette products has designated customs, customs clearance and filing, trading platform filing, etc., and the whole process is “according to documents”.

Tariffs have also increased. In January this year, the UAE and some GCC countries raised tariffs on e-cigarettes and e-liquids from 5% to 100%. Therefore, for the export of electronic cigarettes, it is very important to control logistics costs and select dedicated logistics service providers with corresponding business scope qualifications.

However, the current transportation costs in the Middle East are lower than those in Europe and the United States. The e-cigarette logistics in the Middle East mainly rely on air and sea transportation. The sea transportation is from the Strait of Malacca to the Arabian Sea, which is relatively closer. In addition, there is also a land transportation route in Middle East logistics, which costs less than air and sea transportation, but it is a bit risky to go through local turbulent areas such as Syria.

At the same time, the United Arab Emirates is the financial, economic, shipping and air transportation center of the Middle East, and Dubai is the largest commercial port and trade distribution center in the Middle East. Doing a good job in the UAE (Dubai) market is more conducive to developing other countries in the Middle East. This logistics has natural advantages.

5. Price war.

Because of the relatively large homogeneity of products, in some countries in the Middle East, e-cigarettes have already started a price war.

This is very particular about the strength of the overall brand.

However, countries in the Middle East have hardly introduced policies that are unfriendly to e-cigarettes this year, which can be said to be relatively “loose”. Even Fouad, general manager of MKG’s Saudi Arabia branch, once said: “The Middle East and North Africa region is one of our fastest growing markets. It is expected that the e-cigarette market in this region will grow at a rate of nearly 10%

until 2024.” Although Last year, my china’s share of e-cigarettes exported to the Middle East was only 4-5% (about billions of RMB), but as an emerging market, it is also a market with the most potential.