Product Range:

・Elf Bar BC5000/ZOVOO DRAGBAR B5000 and other disposable e-cigarettes

・Rechargeable e-cigarette devices (such as pen e-cigarettes, small pod, e-cigarette modules), such as JUUL e-cigarette pens and e-cigarette cartridges, myblu e-cigarette modules, etc.

・E-liquids, e-cigarette cartridges and nicotine salts, such as JUUL e-cigarette cartridges

Morocco

・In 2023, the revenue of the e-cigarette field will reach US$41.22 million. The market is expected to grow at an annual rate of 5.37% (compound annual growth rate from 2023 to 2027).

・Compared to global comparison, most revenue comes from the United States (USD 8.279 billion in 2023).

・For the total population, per capita income in 2023 is US$1.46.

I The latest development of the Moroccan e-cigarette market in 2023

The Moroccan government has announced plans to regulate e-cigarettes and other vaping products amid concerns about their impact on public health. The proposed regulations would require manufacturers to add health warnings to their products and prohibit the sale of e-cigarettes to minors. In addition, Morocco has launched a variety of new e-cigarette products in recent years. For example, Chinese e-cigarette brand RELX was launched in the Moroccan market, offering a range of e-cigarette equipment and e-liquids. Other international brands such as JUUL and Vype have also expanded their presence in the Moroccan market. In addition, there are some local companies active in the Moroccan e-cigarette market, such as DariB, a company headquartered in Marrakech. The company offers a range of e-liquids designed to cater to local tastes, including flavors such as mint tea and Moroccan pastries.

E-cigarettes are becoming more widely available in physical retail stores and online, making them more accessible to consumers. There are also a number of regulatory developments that could impact Morocco’s e-cigarette industry. Moreover, the sale and use of e-cigarettes is legal in Morocco. However, the market is relatively small compared to other countries, and e-cigarettes have not yet been widely adopted. Traditional tobacco products, such as cigarettes and shisha, remain the most popular smoking products in the country.

I Morocco e-cigarette market overview

Due to the lower nicotine usage in e-cigarettes, people are increasingly adopting e-cigarettes instead of traditional cigarettes, which has stimulated interest in the Moroccan e-cigarette market, which is expected to achieve gradual growth over the next six years. The majority of consumers love the product. The strong demand for smoking in the country and the variety of flavors of e-cigarettes have attracted the interest of many consumers and led to increased demand for the product in the country, which is expected to further benefit the potential growth of e-cigarettes in the Moroccan e-cigarette market over the next six years.

According to 6Wresearch, the Moroccan e-cigarette market size is expected to show potential growth during 2020-26.

From a product perspective, the rechargeable e-cigarette segment of the Moroccan e-cigarette market is expected to dominate the revenue share of the overall market in the coming years owing to the increasing availability of flavors that are cheap and effective as the product is reused choose. Significant growth in various new product launches attracting consumers towards premium e-cigarette options is expected to accelerate the market growth of the Moroccan e-cigarette market in the coming years.

IWhat are the factors driving the growing demand for e-cigarettes in the Moroccan e-cigarette market?

The Moroccan e-cigarette market is growing due to growing awareness of the health risks associated with traditional smoking. E-cigarettes are seen as a potentially less harmful alternative, a perception that could drive consumer demand for these products.

What are the main factors hindering the growth of the Moroccan e-cigarette market?

The market faces certain challenges such as stringent government regulations and changing consumer attitudes towards smoking.

Which distribution channel has the highest sales?

Online distribution channels account for the highest sales in the Moroccan e-cigarette market.

IWhat are the main trends in the Moroccan e-cigarette market?

E-cigarettes are becoming more widely available in physical retail stores and online, making them more accessible to consumers. There are also regulatory developments that could impact Morocco’s e-cigarette market.

Egypt

・In 2023, the revenue of the e-cigarette field will reach US$370 million. The market is expected to grow at 15.07% annually (CAGR 2023-2027).

・Compared to global comparison, most revenue comes from the United States (USD 8.279 billion in 2023).

・For the total population, per capita income in 2023 is US$5.24.

I Egypt e-cigarette market analysis

The Middle East and Africa e-cigarette market is expected to register a CAGR of 9.74% during the forecast period. Over the past few years, awareness of the health hazards of smoking has increased. When COVID-19 hit, the market collapsed initially due to shipping restrictions and reduced physical store sales, but it served as a break-even point. This trend has led to strong demand for alternatives to traditional cigarettes, such as e-cigarettes; as a result, online sales have increased compared to before. E-cigarettes were introduced as an alternative to traditional cigarettes. According to estimates provided by the World Bank, if the number of smokers could be reduced to half by 2027, 180 million premature deaths could be avoided, and e-cigarettes are an important step towards this goal. With the increasing popularity of e-cigarette devices, the incorporation of different flavors such as menthol, peppermint, chocolate, cola, bubble gum, and other fruits and flavoring substances has attracted many consumers to adopt these e-cigarette devices. Tobacco manufacturers focus on technological development and innovation to gain an advantage over their competitors. This trend has convinced vendors to invest heavily in technology.

I E-cigarette industry segmentation

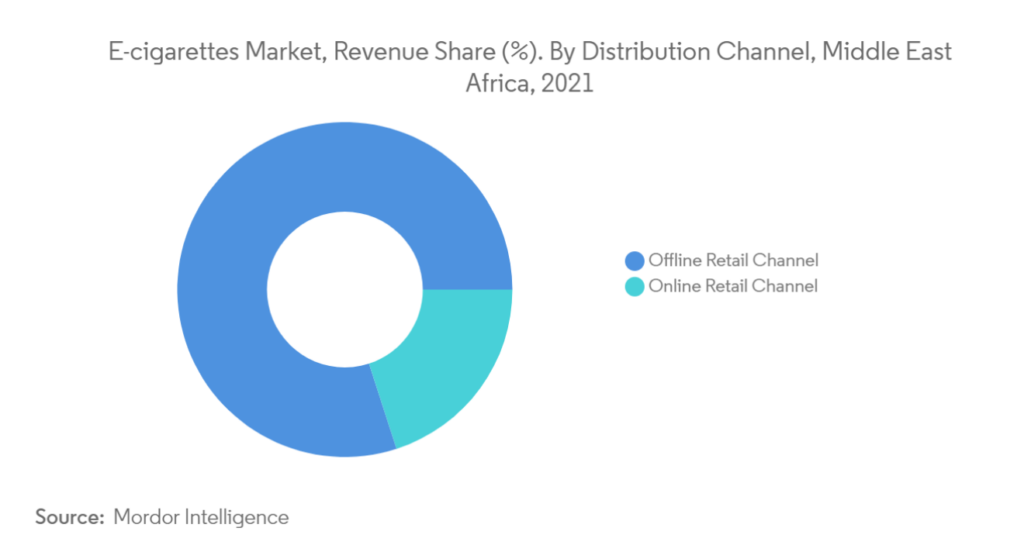

E-cigarettes are sometimes referred to as “e-cigarettes,” “vapes,” “e-hookahs,” “vape pens,” and “electronic nicotine delivery systems (ENDS).” E-cigarettes are also known as vaping devices. They may contain e-liquids and a set of miscellaneous devices that allow users to inhale aerosols containing nicotine, flavors and other flavors. Various flavors such as peppermint, menthol, chocolate, cola, bubble gum, other fruit fusions and flavoring ingredients are attracting many consumers to adopt. The Middle East and Africa e-cigarette market is segmented by product into e-cigarette devices and e-liquid devices. On the basis of distribution channel, the market is divided into offline and online channels. Based on geography, the market is segmented into South Africa, Nigeria, Kenya, Egypt, United Arab Emirates, and Rest of Middle East & Africa.

I E-cigarette market trends

This section covers the key market trends that our research experts believe are shaping the e-cigarette market: e-cigarette penetration in organized retail, the growing retail sector, especially in developing countries, which is characterized by the emergence of many hypermarkets, Stores in the form of supermarkets and specialty stores. The penetration of organized retail is also expected to enable consumers to seek information about various brands and compare prices and quality to make better purchasing decisions. Vendors utilize traditional media and social media platforms for advertising. Companies hold events and exhibitions to promote their brands and products, reaching target audiences through various social media platforms. As demand increases, some companies invest heavily in finding new distribution channels. Therefore, users can purchase e-cigarettes through multiple channels. E-cigarettes have become relatively easy to purchase as e-commerce grows and many retail stores plan to introduce e-cigarettes into their product ranges to combat competition. This factor is driving faster adoption of the product, resulting in healthy market growth.

I Egypt dominates the market

Vaping is a modern trend, but even the new e-cigarettes have roots in ancient history. Egypt is famous for its ancient vaping techniques, such as healing herbs and oils on hot stones to vape. 41.6% of people believe that e-cigarettes help quit smoking, and 31.9% believe that e-cigarettes are less harmful than traditional cigarettes. Vendors operating in the country are launching innovative products in terms of functionality, taste, ingredients, packaging and formats. The increasing consumer awareness and product knowledge of various e-cigarettes has led to the introduction of high-performance and high-quality products into the Egyptian e-cigarette market. Intellicig Egypt’s e-cigarettes and e-liquids revolutionize the smoking experience for smokers. Intellicig is one of the largest e-cigarette manufacturers in the Egyptian market and the only company that provides after-sales service and care to its customers. Countries are pushing to switch from traditional cigarettes to e-cigarettes to address pollution and health concerns and promote sustainability.

I E-cigarette market news

· In April 2022, multinational e-cigarette company RELX International expressed its appreciation for the recent decision of the Egyptian authorities to allow the legal import and commercialization of e-cigarette products in the country. The lifting of the ban highlights the progressive attitude of Egyptian authorities towards e-cigarettes. It lays the foundation for the creation of a regulated market full of business opportunities by meeting the needs of legal age (adult) consumers across the country for easily accessible, quality products.

· In November 2019, the Dubai Department of Economic Development (DED) recently launched a new campaign called “Trade in E-cigarettes and Accessories” under the “Trade in Tobacco and Smoking Accessories” group. This activity is applicable to mainland limited liability companies and will allow investors to legally engage in e-cigarette trading in the local market.

· September 2019: Before 2019, the sale of e-cigarettes was also illegal in Dubai; in April 2019, the UAE Government Consumer Supervision Authority and the Emirates Standardization and Measurement Authority (ESMA) confirmed new regulations for e-cigarettes: as long as they are manufactured The e-cigarettes of this manufacturer comply with the new standards and have health warning packaging similar to cigarette packaging.